QUEENSLAND BORDER RESTRICTIONS - UPDATED August 18, 2020

Learn more HERE

GOVERNMENT RESOURCES AND INFORMATION

QUEENSLAND GOVERNMENT

Essential information on coronavirus and assistance for business and industry from the Queensland and Australian Governments can be found HERE

AUSTRALIAN GOVERNMENT

To find up to date information from the Australian Government regarding its economic response click HERE.

MACKAY REGIONAL COUNCIL

Mackay Regional Council has detailed stage one of business support measures to help assist those impacted by the escalating Coronavirus crisis. The business support response includes waiving a raft of fees for 2020-2021 and a focus on local spend and job creation measures immediately and during the recovery. The due date for the next lot of rates in September will also be extended by three months.

STAGE ONE OF CORONAVIRUS BUSINESS SUPPORT MEASURES

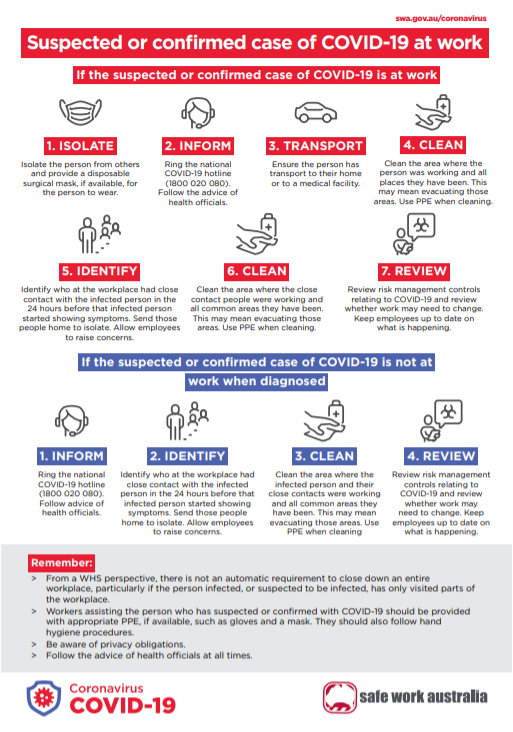

QUICK LINK - WHAT TO DO IF AN EMPLOYEE HAS COVID-19 - INFOGRAPHIC

For more information on workplace health and safety in relation to Covid-19, please visit the SAFE WORK AUSTRALIA website.

HELPLINE AVAILABLE TO BUSINESSES - 13 28 46

The Australian Government’s Business Hotline - 13 28 46 – has been expanded to provide specialist advisers and extended hours to support small and medium businesses impacted by the COVID-19 pandemic. You can also send an email. The Hotline operates seven days per week, and provide an additional two hours a day of support outside standard operating hours for the first month, answering calls from 7.00am to 11.00pm AEST.

EXPORT ADVICE

ADVICE for exporters - from Australian Trade and Investment Commission (Austrade)

HEALTH AND SAFETY RESOURCES

UPDATE TO COVID-19 SAFE WORKPLACE PRINCIPLES - On 24 April 2020, the National Cabinet agreed to the National COVID-19 Safe Workplace Principles. Recognising that the COVID-19 pandemic is a public health emergency, that all actions in respect of COVID-19 should be founded in expert health advice and that the following principles operate subject to the measures agreed and implemented by Governments through the National Cabinet process.

VIEW THE 10 PRINCIPLES HERE | INTERPRETATION OF THE PRINCIPLES

FOGGING DECONTAMINATION Services COVID-19 - from RIN member Clean Feeling

COMPLETE the COVID-19 Infection Control Training - available online at Department of Health

TIPS to protect your mining camp from Novel Coronavirus - from Australasian Mine Safety Journal

INFECTION prevention advice - from the Australian Government

INFECTION prevention advice - from the World Health Organisation

MENTAL HEALTH RESOURCES

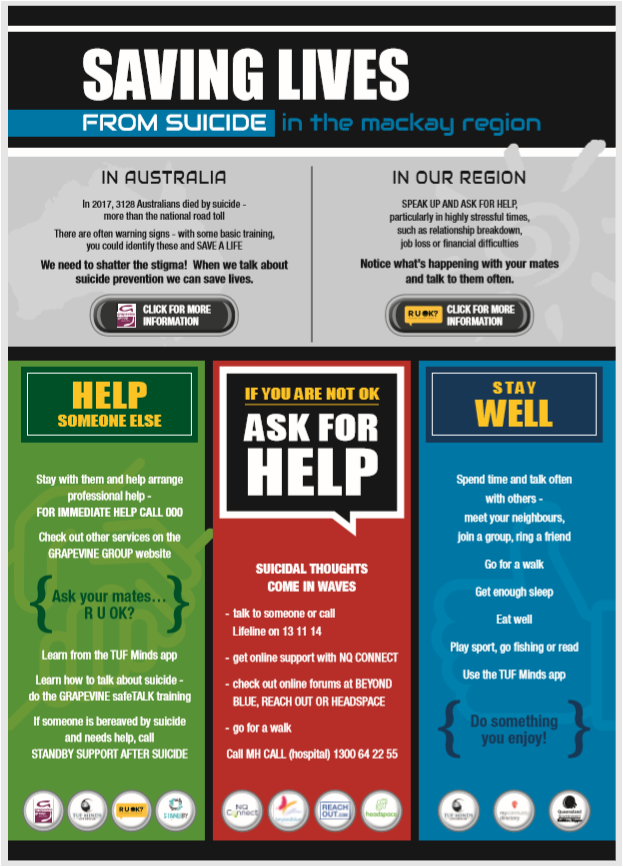

An information package has been compiled by the Suicide Prevention Community Action Planning Group (SPCAP) in the Whitsunday, Isaac and Mackay region and is designed to support regional industry and businesses to access information, resources and support with mental health concerns, particularly with respect to the outbreak of Coronavirus across the world. Now is a good time to check in with your employees and see how they're going. Below you will find some links to information that may assist you and them. There's no denying even the strongest of people will be feeling different in light of the Covid-19 impacts, so let's keep on looking after each other throughout this crisis.

DOWNLOAD SUPPORT RESOURCES HERE

Supporting better mental health through MATES in Mining - MATES in Mining is stepping up in this area to support the workforce. While on-site visits and training may be restricted, the MATES in Mining team is working hard to deliver mental health awareness training and resources virtually via email, phone, webinars, social media and other channels. The infographic below outlines some helpful advice for you and your family. If you or your colleagues need help, the MATES in Mining 24/7 national help line number is 1300 642 111.

Coping with COVID-19 infographic

Looking after your mental health - Beyond Blue recognises and understands the feelings of anxiety, distress and concern many people may be experiencing in relation to the coronavirus (COVID-19) and offers the following wellbeing advice.

Dealing with anxiety - Tips for coping with coronavirus anxiety

Coping with stress - information is for young people affected by stress related to Novel Coronavirus (COVID-19)

Small business owners experiencing mental health issues - Your mental health is important, so it’s good to learn how to recognise warning signs or ‘red flags’ that may suggest you need to reach out for support.

Additional Wellbeing and Support Information

Strategies to stay calm and focused during times of uncertainty - an article from RIN member Sunsuper